One of the most prominent controversies surrounding British populist leader Nigel Farage has been the allegations that he or his team were shorting (i.e. betting against the Pound Sterling) around the time of the Brexit vote. Glenn Stevens looks at the allegations and Farage’s response to them.

The Allegations and Farage’s Role

The “Concession” Statements

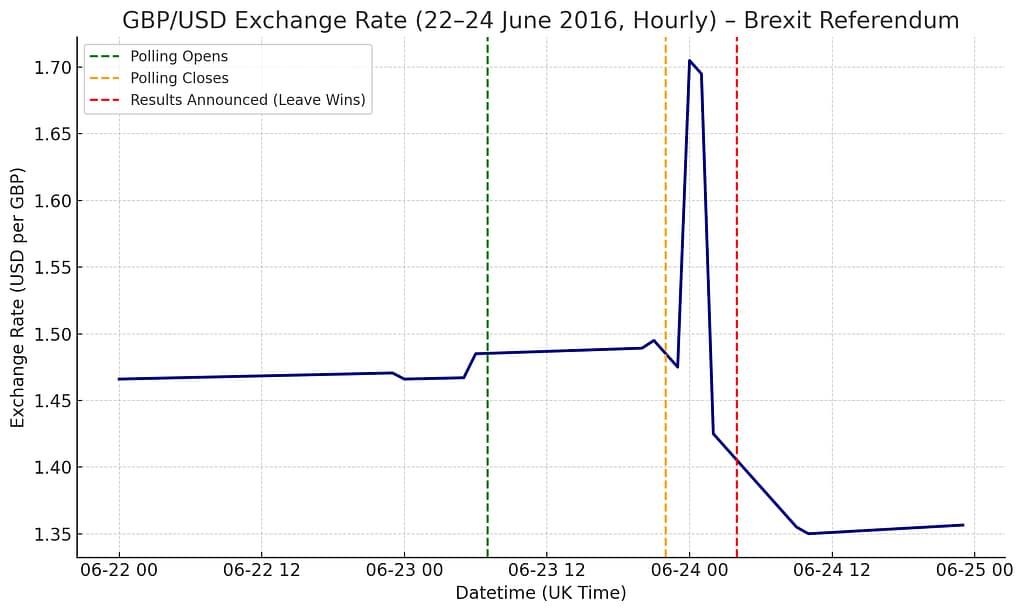

Shortly after polls closed at 10 p.m. on referendum night, Farage gave statements to the media saying he thought “Remain will edge it”. These statements, along with other polls, caused the pound’s value to rise briefly, to over $1.50, before the actual results came in showing a “Leave” victory, at which point the pound crashed dramatically.

The hour-by-hour graph of GBP/USD from 22–24 June 2016, showing the pre-referendum rise, the strength of the pound during polling on the 23rd, and the sharp overnight crash as the Brexit results were confirmed early on the 24th. The initial rise occurred at the time Farage was making concessionary statements to the media.

Private Polling Information

Allegations also centre on the availability of private polling data. Investigations by Bloomberg and others revealed that Farage had been provided with information from private polls commissioned by Leave supporters that were more accurate than public polls and predicted a “Leave” win. This led to the theory that his public “concession” was a ploy to manipulate the markets. The Bloomberg investigation is corroborated in books by Arron Banks and the political journalist Tim Shipman, both said Farage learned the results of “an unidentified, financial services exit poll” before polling stations closed at 10pm.

Farage told Bloomberg that the only external exit poll he received on the day of the referendum was conducted by Survation. Survation’s poll accurately predicted that Leave would win the referendum. He assured Bloomberg that he learned of the results of the exit poll “minutes after” Sky broadcast his comments.

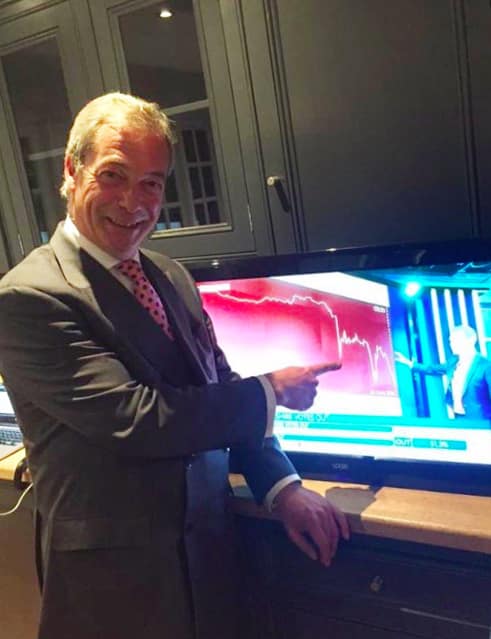

That image

Social media commentary alleging that Farage gained financially from the events of the 23rd June 2016 is often accompanied by an unattributed image showing a jubilant Farage in front of a tv screen showing the plight of the Pound after the Brexit results came through.

Hedge Fund Profits

Commentators often point to the activities of certain hedge funds at the time of the Brexit vote. Knowing the potential to main huge sums of money, these hedge funds hired some of Britain’s top polling companies to help them predict the outcome.

Brexit-supporting hedge fund manager Crispin Odey, a major Leave donor, had “shorted” sterling (bet against the pound) and moved a large portion of his fund into gold in anticipation of a Leave vote. His fund made an estimated £220 million in a few hours after the crash. Other hedge funds using private data also made millions.

In an opinion piece in the Guardian, the economist and Green Party politician Molly Scott Cato wrote “The threats posed by leaving the EU to the many – our jobs, rights and protections – seem to be benefiting an elite few. These City wide boys – the real “bad boys” of Brexit – have used and continue to use Brexit as a way to swell their own wealth and power.”

Adviser’s profit

According to an article published in The Sun, Hermann Kelly, Farage’s then-director of communications in Brussels, reportedly made £9,500 by shorting the pound against the dollar on the night, doubling his money in just five hours.

On the 23rd June, at 10:06pm just after Farage had made his concessionary statements to media outlets, Kelly posted an image to what was then Twitter. He wrote, “We have all changed the directn [sic] of Europe We shook up the world! So proud to have done my part with @Nigel_Farage”

Farage’s Response

Nigel Farage has always denied he was personally involved in any shorting exercise. On Monday 25th June 2016, a spokesperson stated that Farage “had no financial interest in currency movements on the night of Brexit”. When asked directly about shorting the Pound by Tim Shipman for a piece in The Times in October 2016, Farage responded “No, no, no, no. I wasn’t shorting it — I should have done!” He also denied having knowledge of polling in advance of making his concessionary statements in the minutes after the polls closed, statements which caused the Pound to surge before crashing when the actual results became known.

Final thoughts

It is not disputed that some people made a lot of money out of shorting both the British Pound and shares in those companies expected to be adversely affected by leaving the European Union. Farage has issued strong denials of having directly benefited in the way these others had. However, strong suspicions remain over whether Farage had known about polling data indicating a Leave win when, in the minutes after the polls had closed, he made concessionary statements suggesting a narrow Remain win.